InstaForexRebat

CG Hardcore Club

- Messages

- 58,370

- Joined

- Nov 9, 2008

- Messages

- 58,370

- Reaction score

- 5,557

- Points

- 721

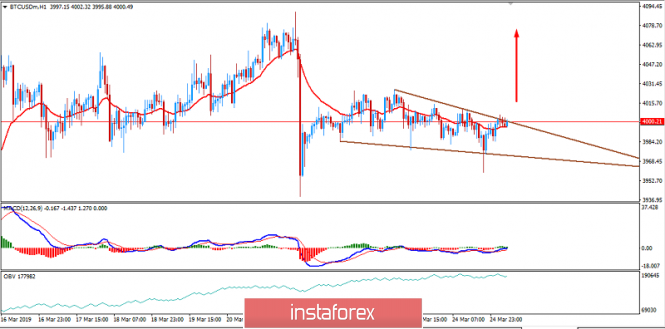

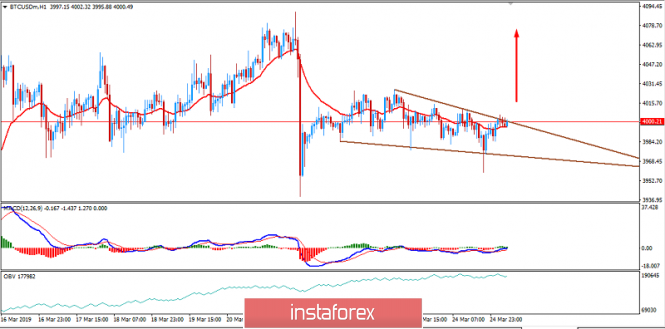

BITCOIN Analysis for March 25, 2019

The price recently formed a downward sloping triangle. If the pattern is broken, a further step will be to break above $4,000. This will lead the price higher towards $4,250 in the coming days.

The volatility is still quite high in Bitcoin. However, the price is likely to create a clear path to progress higher after a breakout above this corrective structure. As the price remains above $3,800-80 support area, the bullish bias is expected to continue further.

Bitcoin has been struggling and consolidating at the edge of $4,000 after impulsive bearish pressure observed recently which aroused after the rejection off the $4,100 area. Though the bearish pressure was very impulsive, it failed to sustain the impulsive bearish momentum to push the price even lower.

The price recently formed a downward sloping triangle. If the pattern is broken, a further step will be to break above $4,000. This will lead the price higher towards $4,250 in the coming days.

The volatility is still quite high in Bitcoin. However, the price is likely to create a clear path to progress higher after a breakout above this corrective structure. As the price remains above $3,800-80 support area, the bullish bias is expected to continue further.

SUPPORT: 3,500-600, 3,800-80

RESISTANCE: 4,000, 4,250, 4,500

BIAS: BULLISH

MOMENTUM: VOLATILE