InstaForexRebat

CG Hardcore Club

- Messages

- 58,370

- Joined

- Nov 9, 2008

- Messages

- 58,370

- Reaction score

- 5,557

- Points

- 721

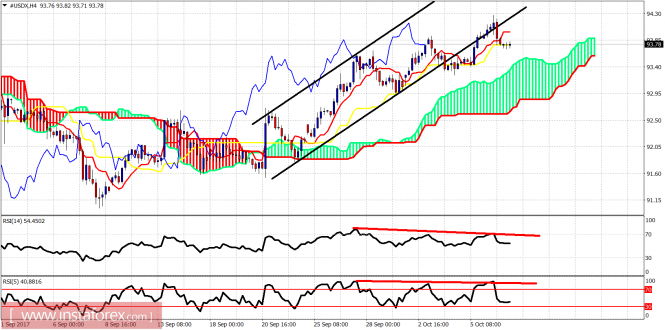

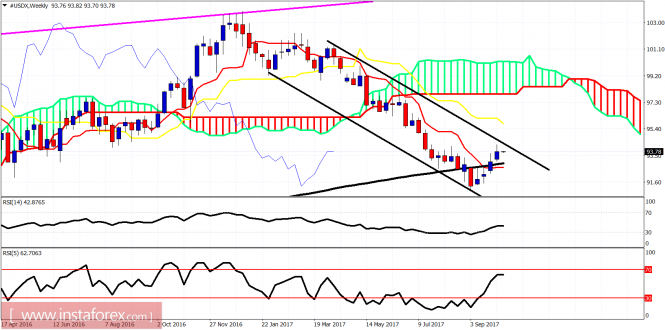

The dollar has prospects for growth

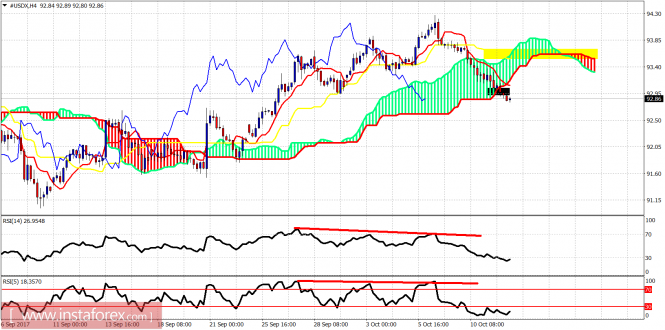

Extremely weak data on the number of new jobs did not put pressure on the US dollar. In point of fact, the number of new jobs in the United States was expected by everyone in the market to decline. But the American economy was not expected to acquire any of them and even lost it. According to the data provided by the Ministry of Labor, the number of new jobs in the non-agricultural sector of the economy fell by 33,000 in September against the median forecast of growth by 90,000. At the same time, the unemployment rate fell to 4.2% from 4.4%, the values from the beginning of "zero".

But, strangely enough, these figures did not shock the market participants, as everyone understood that the emergency situation in the southern states of the country, as well as on the islands, would lead to a drop in business activity and to the temporary closure of many firms, resulting to a skew in the incoming statistics . It is likely that the October values in the number of new jobs under the non-agricultural sector of the economy will show the strongest growth, as it has repeatedly occurred earlier in periods of harsh and snowy winters in Northern America.

If the markets did not actually react to the labor market statistics, then they quickly responded to the publication of data which is the stronger increase of average wage rate by 0.5% Instead of the expected value of 0.3% and the increase of 0.2% in August. These data significantly increased the expectations of December growth rates from the Fed. According to the data on federal funds future rates, the probability of another rate increase in December by 0.25% to 1.50% has increased to 91.7%. Hence, market players are absolutely certain that the rates will be raised.

Evaluating this situation, we can assume that if something does not happen uncontrollably, then the US dollar will continue to smoothly strengthen against the major currencies after some weak correction.

Extremely weak data on the number of new jobs did not put pressure on the US dollar. In point of fact, the number of new jobs in the United States was expected by everyone in the market to decline. But the American economy was not expected to acquire any of them and even lost it. According to the data provided by the Ministry of Labor, the number of new jobs in the non-agricultural sector of the economy fell by 33,000 in September against the median forecast of growth by 90,000. At the same time, the unemployment rate fell to 4.2% from 4.4%, the values from the beginning of "zero".

But, strangely enough, these figures did not shock the market participants, as everyone understood that the emergency situation in the southern states of the country, as well as on the islands, would lead to a drop in business activity and to the temporary closure of many firms, resulting to a skew in the incoming statistics . It is likely that the October values in the number of new jobs under the non-agricultural sector of the economy will show the strongest growth, as it has repeatedly occurred earlier in periods of harsh and snowy winters in Northern America.

If the markets did not actually react to the labor market statistics, then they quickly responded to the publication of data which is the stronger increase of average wage rate by 0.5% Instead of the expected value of 0.3% and the increase of 0.2% in August. These data significantly increased the expectations of December growth rates from the Fed. According to the data on federal funds future rates, the probability of another rate increase in December by 0.25% to 1.50% has increased to 91.7%. Hence, market players are absolutely certain that the rates will be raised.

Evaluating this situation, we can assume that if something does not happen uncontrollably, then the US dollar will continue to smoothly strengthen against the major currencies after some weak correction.